5. More complex scenarios#

The preceding chapter introduced four different ways of preparing a solution and the forms the backbone of running simulations on World Bank models in ModelFlow. This chapter builds on those examples and delves into some of the challenges involved in translating a real-world policy problem into the model-world and then back again.

The particular scenario to be examined is the introduction of a Carbon Tax. The model used, and the example presented are both taken from the model of Pakistan presented in Burns et al.(2021).

In this chapter - More Complex Scenarios

This chapter presents some more complex scenarios, and illustrates how to develop a script that introduces changes to the model.

A complex scenario is developed as deficiencies in initial scenarios are unearthed. Scenarios presented include:

The introduction of a simple carbon tax (a simple shock of an exogenous variable) three exogenous variables in this case.

Upon examining results, it is recognized that the initial nominal shocks loses impact over time because of inflation. Therefore, the shock is re-estimated as an ex-ante real shock (i.e. the initial shock is up-scaled over time in line with inflation to keep its real value constant).

This example is judged imperfect because it does not account for the in-scenario inflation impacts. In a third scenario, the model equations are adjusted so that the ex-post inflation rate is used to maintain the real-value of the Carbon tax.

The chapter also illustrates how to modify the description of variables in a scenario, and illustrates various techniques for visualizing scenario results.

5.1. Load a pre-existing model, data and descriptions#

After initializing a ModelFlow pandas session in the usual way, the Pakistan model, which is comprised of the model object, its estimated equations and the data is loaded. The pcim file was created by the World Bank from a slightly modified version of the original EViews model used in the paper (Burns et al.,2021).

mpak,bline = model.modelload('../models/pak.pcim',alfa=0.7,run=1,keep="Baseline")

Zipped file read: ..\models\pak.pcim

5.2. The policy problem#

The model object mpak loaded above contains the model instance, the variables, equations and the data for the model. On load, the model was solved, and the results of that initial solve was assigned to the DataFrame bline.

The Pakistan model contains three carbon tax variables:

Mnemonic |

Meaning |

|---|---|

PAKGGREVCO2CER |

The effective carbon tax rate on Coal |

PAKGGREVCO2GER |

The effective carbon tax rate on Gas |

PAKGGREVCO2OER |

The effective carbon tax rate on Crude Oil |

As discussed in earlier chapters the meaning of the mnemonics can be retrieved from the model object mpakusing the .des method and a wild-card search.

mpak['PAKGGREVCO2*ER'].des

PAKGGREVCO2CER : Carbon tax on coal (USD/t)

PAKGGREVCO2GER : Carbon tax on gas (USD/t)

PAKGGREVCO2OER : Carbon tax on oil (USD/t)

Alternatively, one can search on the variable descriptions to retrieve the mnemonics of variables. Below, the exclamation mark (!) at the beginning of the string notifies the matching algorithm to search the variables’ descriptions (not the mnemonics) and return all variables that match.

mpak['!*Carbon*'].des

PAKCCEMISCO2TKN : Total Carbon emissions (tons)

PAKGGREVCO2CER : Carbon tax on coal (USD/t)

PAKGGREVCO2GER : Carbon tax on gas (USD/t)

PAKGGREVCO2OER : Carbon tax on oil (USD/t)

Technqiues to query the model object for the meaning of mnemonics or the mnemonics associated with economic concepts are discussed in more detail here: [1].

5.3. Add variable descriptions#

A ModelFlow model imported from EViews will inherit the variable descriptors coming from Eviews. The variable descriptors are stored in a dictionary named: .var_description. Not all EViews variables will necessarily have a description so additional definitions (descriptions) may need to be provided.

Below we define a python dictionary in the same format as the dictionary var_description that is contained in the model object mpak. Each dictionary entry is comprised of a key (the variables mnemonic) and a value (the description of the variable).

extra_description = {'PAKNYGDPMKTPKN': 'GDP',

'EMISCOAL' : 'Coal emissions',

'EMISGAS' : 'Gas Emissions',

'EMISOIL' : 'Gas Emissions',

'PAKCCEMISCO2CKN' : 'Coal emissions, tCO2e',

'PAKCCEMISCO2GKN' : 'Natural Gas emissions, tCO2e',

'PAKCCEMISCO2OKN' : 'Crude Oil emissions, tCO2e',

'PAKCCEMISCO2TKN' : 'Total emissions, tCO2e',

'PAKGGREVEMISCN' : 'Revenue from emissions taxes',

'PAKLMUNRTOTLCN': 'Unemployment rate',

'PAKGGDBTTOTLCN_': 'Debt (%GDP)',

'PAKGGREVTOTLCN': 'Fiscal revenues',

'PAKWDL': 'Working days lost due to pollution'}

These new definitions can be merged with the existing description by using the | operator.

The command

mpak.var_description = mpak.var_description | extra_description

Sets mpak.var_description to a merge between the contents of the dictionary: mpak.var_description (its current content) and the dictionary: extra_description

Following execution, the .var_desciption will be changed to contain both its old values and those added in the extra_description dictionary defined above.

mpak.var_description = mpak.var_description | extra_description

Several ModelFlow methods take advantage of this dictionary to provide more reader-friendly descriptions of variables – typically through the rename option. For those methods that define it, if rename is set to True, the method will substitute the description for the variable name in any outputs.

Variables with descriptions can also be selected for by using the mpak['!*subtext*'] syntax, where subtext is some text that appears in the variable descriptor.

5.4. Simulating the impact of imposing a carbon price#

To run a simulation, the following steps must invariably be followed.

Create a new DataFrame, typically a copy of an existing one.

Change the value in the new df of the variable(s) to be shocked.

Solve the model using the newly altered df as the input df.

# Create copy of the bline df

alternative_df = bline.copy()

#set the effective carbon tax of all three carbon tax variables equal to 30 USD

alternative_df.loc[2025:2100,['PAKGGREVCO2CER','PAKGGREVCO2GER', 'PAKGGREVCO2OER']] = 30

The above used the pandas function .loc[] to change the Carbon Tax rate variables.

The ModelFlow method .upd() could be used to perform the same change.

# This ModelFlow command is equivalent to the previous standard pandas command abive that used the .loc[] syntax

CT30df = bline.upd("<2025 2100> PAKGGREVCO2CER PAKGGREVCO2GER PAKGGREVCO2OER = 30")

5.4.1. Solve the model#

Solving the model is as simple as calling the mpak function with the altered DataFrame as an input and assigning the results to a new dataframe (resultsdf in this instance). The keep option causes a copy of the dataframe to be stored within the mpak model object.

resultsdf = mpak(CT30df,2020,2100,keep="Nominal $30USD Carbon tax") # simulates the model

Note

This simulation is a shock on an exogenous variable (the first kind of shock discussed in the previous chapter), although in this case the shock is applied to three exogenous variables simultaneously, whereas in earlier examples only one variable was shocked.

5.4.1.1. Examining the results#

Every time the model is solved the results of the simulation are assigned to a variable on the left hand side of the solve call (resultdf in the example above). The results of the most recent scenario are also always stored in the .lastdf DataFrame that is one of the properties of any ModelFlow model object (mpak in this case). basedf is also a property of mpak and contains a copy of the initial DataFrame from which the model was built.

The bline, .basedf and the original .lastdf Dataframes were created when the model was initially loaded and solved. The resultsdf database and a revised .lastdf were generated when the model was solved for the new carbon prices.

Note

The standard dataframes are part of the ModelFlow object and managed by it.

mpak.basedf:

Dataframewith the values for baselinempak.lastdf:

Dataframewith the values from the most recent simulation

The command below shows the results of the simulation on the four emissions variables in the model expressed as a percent deviation from the level of the baseline (the .difpctlevel operator below), and where the mnemonics have been replaced by their descriptions using the .rename option.

with mpak.set_smpl(2023,2030):

print(mpak['PAKCCEMISCO2*'].difpctlevel.rename().df);

Coal emissions, tCO2e Natural Gas emissions, tCO2e \

2023 0.00 0.00

2024 0.00 0.00

2025 -41.19 -26.99

2026 -40.06 -25.72

2027 -38.85 -24.48

2028 -37.59 -23.30

2029 -36.26 -22.14

2030 -34.89 -21.01

Crude Oil emissions, tCO2e Total emissions, tCO2e

2023 0.00 0.00

2024 0.00 0.00

2025 -10.93 -22.17

2026 -10.98 -21.56

2027 -10.89 -20.89

2028 -10.68 -20.17

2029 -10.35 -19.38

2030 -9.95 -18.55

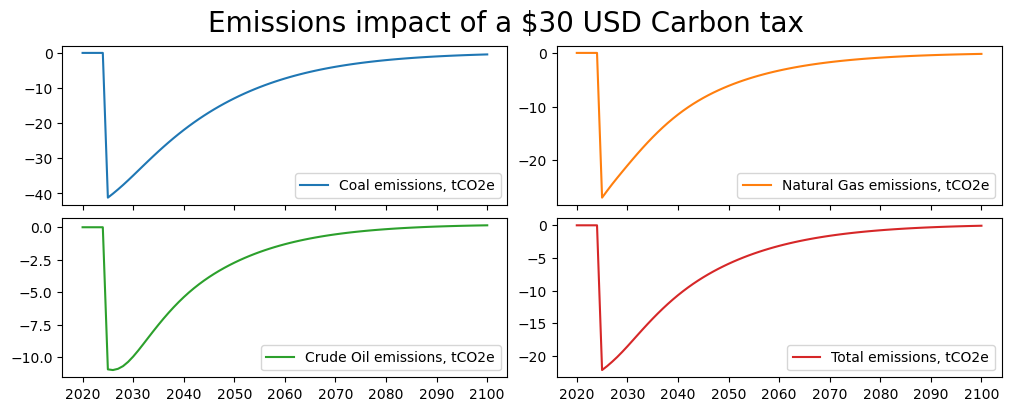

The impact of the imposition of the carbon tax in the model is relatively quick, resulting in an overall decline in emissions of 22.2% in the first year, with coal emissions (coal is a relatively carbon intensive source of energy so harder hit by the carbon tax) recording the biggest hit at -41.2 percent.

mpak['PAKCCEMISCO2?KN'].difpctlevel.rename().plot(title="Emissions impact of a $30 USD Carbon tax");

Abstracting from the fact that the impact is occurring too quickly (it would take time for the substitution towards alternative sources of power to occur), the fact that impacts are fading with time suggests an error in the specification of the shock.

Indeed, high domestic inflation means that the real price change of the $30 nominal increase in the Carbon price is declining over time – suggesting that the scenario needs tweaking.

5.5. Re-thinking the shock as an ex-ante real shock#

Inflation in Pakistan is relatively high so a $30 shock quickly loses its relative price effect. Increasing the nominal value of the Carbon Tax by the amount of domestic inflation (converted into USD each year) would resolve the problem.

Below a new DataFrame is created as a copy of the baseline and the three Carbon taxes are first set to $30 in 2025 and then grown at the rate of domestic inflation to keep the ex ante relative price of the Carbon Tax constant.

Finally the model is re-solved.

CT30realdf = bline.copy()

CT30realdf=CT30realdf.upd("<2025 2025> PAKGGREVCO2CER PAKGGREVCO2OER PAKGGREVCO2GER = 30")

#NB: Variables used

# PAKNECONPRVTXN is the consumer price deflator

# PAKPANUSATLS id the USD exchange rate

CT30realdf=CT30realdf.mfcalc('''

<2026 2100> PAKGGREVCO2CER = PAKGGREVCO2CER(-1)*(PAKNECONPRVTXN*PAKPANUSATLS)/(PAKNECONPRVTXN(-1)*PAKPANUSATLS(-1))

PAKGGREVCO2OER = PAKGGREVCO2OER(-1)*(PAKNECONPRVTXN*PAKPANUSATLS)/(PAKNECONPRVTXN(-1)*PAKPANUSATLS(-1))

PAKGGREVCO2GER = PAKGGREVCO2CER(-1)*(PAKNECONPRVTXN*PAKPANUSATLS)/(PAKNECONPRVTXN(-1)*PAKPANUSATLS(-1))

''')

CT30realdf.loc[2023:2030,'PAKGGREVCO2CER']

resultsdf = mpak(CT30realdf,2020,2100,keep="Ex ante Real $30USD Carbon tax") # simulates the model

The above code first sets the Carbon prices to 30USD and then grows them at the same rate as inflation. Below we see that with inflation of 30% per annum the domestic carbon price is rising rapidly.

with mpak.set_smpl(2023,2030):

print(mpak['PAKGG*ER'].rename().df)

Carbon tax on coal (USD/t) Carbon tax on gas (USD/t) \

2023 -5.55 -41.00

2024 -5.55 -41.00

2025 30.00 30.00

2026 31.83 31.83

2027 33.64 33.64

2028 35.45 35.45

2029 37.26 37.26

2030 39.09 39.09

Carbon tax on oil (USD/t)

2023 -8.71

2024 -8.71

2025 30.00

2026 31.83

2027 33.64

2028 35.45

2029 37.26

2030 39.09

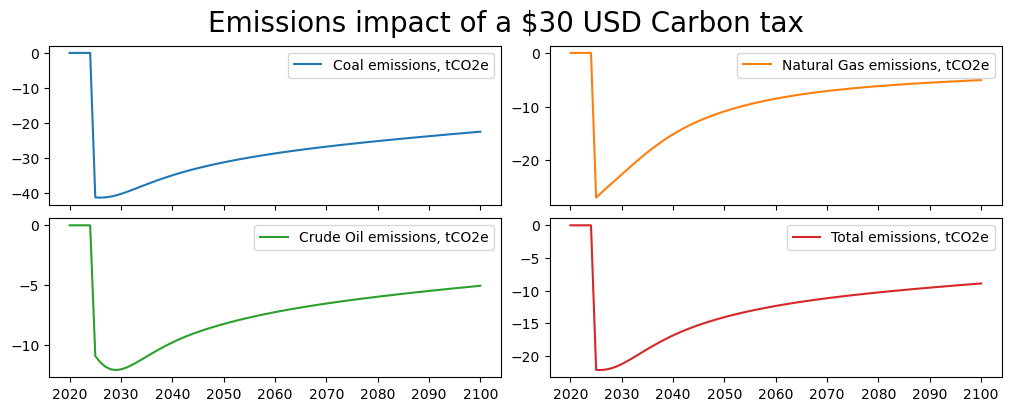

mpak['PAKCCEMISCO2?KN'].difpctlevel.rename().plot(title="Emissions impact of a $30 USD Carbon tax");

These results are better, but still there is an erosion of the effect of the tax.

On introspection, this is likely due to the fact that the carbon tax itself is inflationary. As a result, prices probably rose to a higher level than supposed by the ex ante calculation.

To deal with this, a different approach is needed. Rather than maintaining the carbon price as an exogenous variable, instead it should be made an endogenous variable by changing the model and adding equations for all of the carbon tax variables.

Before doing so lets save the current version of the model for further work later.

mpak.modeldump('../models/pakCarbonTaxScenarios.pcim')

5.6. Changing the model – modifying and or adding equations#

To endogenize the carbon price, an equation for each carbon price has to be added to the model. This can be done with the .equpdate() method.

#Reload original model and data

mpak1,bline = model.modelload('../models/pak.pcim',alfa=0.7,run=1,keep="Baseline")

#Create a new model object mpakreal and new baseline dataframe-- baselinereal

#The nominal carbon taxes (expressed in USD) are now endogenous

#and increase with domestic inflation and the exchange rate

mpakreal,blinereal = mpak1.equpdate('''

<fixable> PAKGGREVCO2CER = PAKGGREVCO2CER(-1) * (PAKNYGDPMKTPXN*PAKPANUSATLS) / (PAKNYGDPMKTPXN(-1)*PAKPANUSATLS(-1))

<fixable> PAKGGREVCO2OER = PAKGGREVCO2OER(-1) * (PAKNYGDPMKTPXN*PAKPANUSATLS) / (PAKNYGDPMKTPXN(-1)*PAKPANUSATLS(-1))

<fixable> PAKGGREVCO2GER = PAKGGREVCO2GER(-1) * (PAKNYGDPMKTPXN*PAKPANUSATLS) / (PAKNYGDPMKTPXN(-1)*PAKPANUSATLS(-1))

''',add_add_factor=False, calc_add=False,newname='Pak model, with real Carbon price equations')

Zipped file read: ..\models\pak.pcim

The model:"PAK" got new equations, new model name is:"Pak model, with real Carbon price equations"

New equation for For PAKGGREVCO2CER

Old frml :new endogeneous variable

New frml :FRML <fixable> PAKGGREVCO2CER = (PAKGGREVCO2CER(-1)*(PAKNYGDPMKTPXN*PAKPANUSATLS)/(PAKNYGDPMKTPXN(-1)*PAKPANUSATLS(-1)))* (1-PAKGGREVCO2CER_D)+ PAKGGREVCO2CER_X*PAKGGREVCO2CER_D$

Adjust calc:No frml for adjustment calc

New equation for For PAKGGREVCO2OER

Old frml :new endogeneous variable

New frml :FRML <fixable> PAKGGREVCO2OER = (PAKGGREVCO2OER(-1)*(PAKNYGDPMKTPXN*PAKPANUSATLS)/(PAKNYGDPMKTPXN(-1)*PAKPANUSATLS(-1)))* (1-PAKGGREVCO2OER_D)+ PAKGGREVCO2OER_X*PAKGGREVCO2OER_D$

Adjust calc:No frml for adjustment calc

New equation for For PAKGGREVCO2GER

Old frml :new endogeneous variable

New frml :FRML <fixable> PAKGGREVCO2GER = (PAKGGREVCO2GER(-1)*(PAKNYGDPMKTPXN*PAKPANUSATLS)/(PAKNYGDPMKTPXN(-1)*PAKPANUSATLS(-1)))* (1-PAKGGREVCO2GER_D)+ PAKGGREVCO2GER_X*PAKGGREVCO2GER_D$

Adjust calc:No frml for adjustment calc

As written, the .equpdate() command creates a new model, which is a copy of the existing model with three new equations.

Each equation grows the nominal rate of the carbon tax at the same rate as ex post inflation (PAKNECONPRVTXN) converted into USD via the exchange rate PAKPANUSATLS. The equations are introduced as exogenizable equations (as distinct from an identity which must always hold) by adding the <fixable> prefix to each equation. The equations are not estimated, so no add-factors are included in the equations.

The output for the .equpdate() reports the actual formulae included in the model.

New equation for For PAKGGREVCO2CER

Old frml :new endogeneous variable

New frml :FRML <fixable> PAKGGREVCO2CER = (PAKGGREVCO2CER(-1)*(PAKNECONPRVTXN*PAKPANUSATLS)/(PAKNECONPRVTXN(-1)*PAKPANUSATLS(-1)))* (1-PAKGGREVCO2CER_D)+ PAKGGREVCO2CER_X*PAKGGREVCO2CER_D$

Adjust calc:No frml for adjustment calc

Note that because the equations are to be fixable, an _X and _D variable are added to the specified equations. Combined they effectively split each equation into two:

the specified equations when _D equals zero

equal to _X when the _D equals one.

The newly created model is given the name mpakreal and is given a text description.

Following the addition of the equations, the new variables (_D and _X) must be initialized. The _X variables are made equal to the current values of the various tax rates, while the _D is set to 1 everywhere – effectively turning the equation off and re-creating the same situation as the initial model where the tax rates are fully exogenous.

As with the mpak model the variable descriptions need to be updated.

mpakreal.var_description = mpakreal.var_description | extra_description

#Exogenizes the newly added equations and sets the dummy =1 amd the _x to the current value of the dependent variable

bline_real=mpakreal.fix(blinereal,'PAKGGREVCO2CER PAKGGREVCO2GER PAKGGREVCO2OER')

The folowing variables are fixed

PAKGGREVCO2CER

PAKGGREVCO2GER

PAKGGREVCO2OER

Finally the new model is solved, the result is kept in a new baseline and a quick check ensures that the model did indeed reproduce the data that it was originally fed, including the initial Carbon Tax levels.

#Solve the model for the new baseline

res = mpakreal(bline_real,2021,2100,alfa=0.5,keep='Baseline - adjusted model')

mpakreal['PAKNYGDPMKTPKN PAKNECONPRVTXN PAKGGBALOVRL PAKGGREVCO2CER PAKCCEMISCO2TKN'].difpctlevel.rename().df

| GDP | Implicit LCU defl., Pvt. Cons., 2000 = 1 | Carbon tax on coal (USD/t) | Total emissions, tCO2e | |

|---|---|---|---|---|

| 2021 | 0.00 | 0.00 | -0.00 | 0.00 |

| 2022 | 0.00 | 0.00 | -0.00 | 0.00 |

| 2023 | 0.00 | 0.00 | -0.00 | 0.00 |

| 2024 | 0.00 | 0.00 | -0.00 | 0.00 |

| 2025 | 0.00 | 0.00 | -0.00 | 0.00 |

| ... | ... | ... | ... | ... |

| 2096 | 0.00 | 0.00 | -0.00 | 0.00 |

| 2097 | 0.00 | 0.00 | -0.00 | 0.00 |

| 2098 | 0.00 | 0.00 | -0.00 | 0.00 |

| 2099 | 0.00 | 0.00 | -0.00 | 0.00 |

| 2100 | 0.00 | 0.00 | -0.00 | 0.00 |

80 rows × 4 columns

5.6.1. Solving the revised model#

With the new model generated, it can now be solved with the real tax rate endogenized in the forecast period. This involves three steps.

Set the nominal tax rate to 30 in 2025

Now Endogenize the equation for the rest of the period

Solve the model.

scenario_real_CTax = bline_real.upd('''

<2025 2025>

PAKGGREVCO2CER_X PAKGGREVCO2GER_X PAKGGREVCO2OER_X = 30 # Sets the exogenous value to 30 in 2025

<2026 2100 >

PAKGGREVCO2CER_D PAKGGREVCO2GER_D PAKGGREVCO2OER_D = 0 # Endogenizes the new equations for the rest of time so that the real-rate stays at 30USD

''')

_ = mpakreal(scenario_real_CTax,2021,2100,alfa=0.5,keep='Real model real tax = 30 at 2025 prices and exchange rates')

Initially the Carbon tax comes in at 30 but gradually its rate in USD rises in line with inflation such that it reaches $1358 by 2100.

mpakreal['PAKGGREVCO2?ER PAKNECONPRVTXN PAKNYGDPMKTPXN '].rename().df

| Carbon tax on coal (USD/t) | Carbon tax on gas (USD/t) | Carbon tax on oil (USD/t) | Implicit LCU defl., Pvt. Cons., 2000 = 1 | GDP, Marker Prices, LCU Price defl., 2000 = 1 | |

|---|---|---|---|---|---|

| 2021 | -5.55 | -41.00 | -8.71 | 1.82 | 1.95 |

| 2022 | -5.55 | -41.00 | -8.71 | 1.98 | 2.14 |

| 2023 | -5.55 | -41.00 | -8.71 | 2.14 | 2.32 |

| 2024 | -5.55 | -41.00 | -8.71 | 2.30 | 2.50 |

| 2025 | 30.00 | 30.00 | 30.00 | 2.51 | 2.72 |

| ... | ... | ... | ... | ... | ... |

| 2096 | 1098.50 | 1098.50 | 1098.50 | 106.62 | 112.39 |

| 2097 | 1158.34 | 1158.34 | 1158.34 | 112.69 | 118.75 |

| 2098 | 1221.44 | 1221.44 | 1221.44 | 119.11 | 125.47 |

| 2099 | 1287.97 | 1287.97 | 1287.97 | 125.89 | 132.58 |

| 2100 | 1358.11 | 1358.11 | 1358.11 | 133.06 | 140.08 |

80 rows × 5 columns

This seemingly very high level is just a reflection of the 75 years of inflation that compounded require a much higher nominal Carbon tax rate to have the same relative price effect. The cumulative effect of inflation in the range of 5.5 real per annum causes the price level to increase 74 times (7400 percent increase 133/1.8 from fourth data column in the above table).

The table below shows the same data but in growth rate terms – indicating that the nominal Carbon tax rate is gradually rising each year in line domestic inflation adjusted for the exchange rate – i.e. it is constant in real terms.

mpakreal['PAKGGREVCO2?ER PAKPANUSATLS PAKNYGDPMKTPXN'].pct.rename().df

| Carbon tax on coal (USD/t) | Carbon tax on gas (USD/t) | Carbon tax on oil (USD/t) | Exchange rate LCU / US$ - Pakistan | GDP, Marker Prices, LCU Price defl., 2000 = 1 | |

|---|---|---|---|---|---|

| 2021 | 0.00 | 0.00 | 0.00 | -0.16 | 10.69 |

| 2022 | 0.00 | 0.00 | 0.00 | -0.16 | 9.76 |

| 2023 | 0.00 | 0.00 | 0.00 | -0.14 | 8.71 |

| 2024 | 0.00 | 0.00 | 0.00 | -0.12 | 7.76 |

| 2025 | -640.56 | -173.17 | -444.41 | -0.30 | 8.90 |

| ... | ... | ... | ... | ... | ... |

| 2096 | 5.45 | 5.45 | 5.45 | -0.20 | 5.66 |

| 2097 | 5.45 | 5.45 | 5.45 | -0.20 | 5.66 |

| 2098 | 5.45 | 5.45 | 5.45 | -0.20 | 5.66 |

| 2099 | 5.45 | 5.45 | 5.45 | -0.20 | 5.66 |

| 2100 | 5.45 | 5.45 | 5.45 | -0.20 | 5.66 |

80 rows × 5 columns

5.6.2. Results#

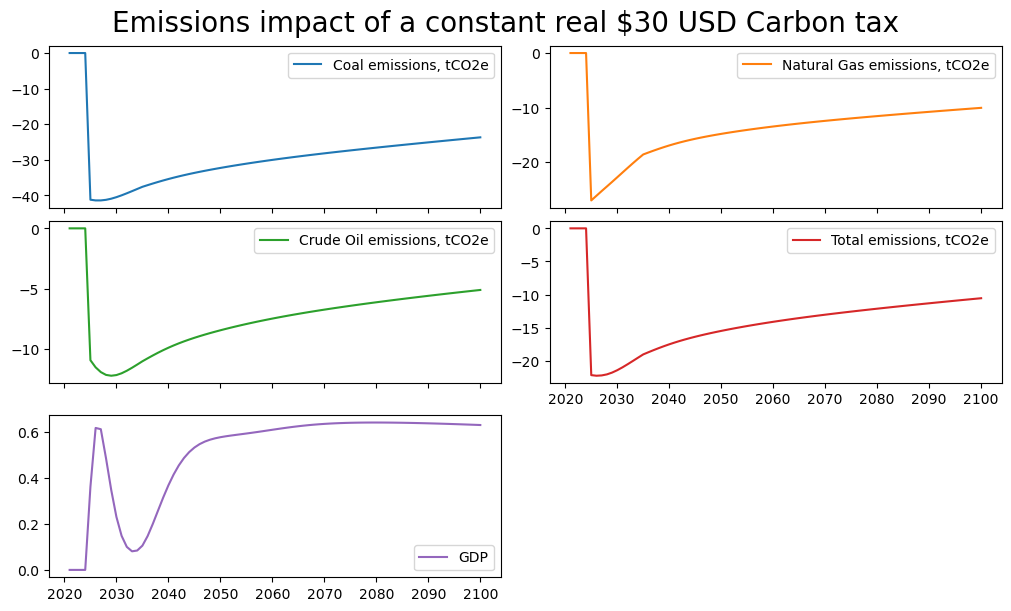

The results from the simulation with the Carbon Tax rate endogenized so as to maintain its real value over time, are broadly consistent with the results from the ex ante real scenario performed above.

mpakreal['PAKCCEMISCO2?KN'].difpctlevel.rename().df

| Coal emissions, tCO2e | Natural Gas emissions, tCO2e | Crude Oil emissions, tCO2e | Total emissions, tCO2e | |

|---|---|---|---|---|

| 2021 | 0.00 | 0.00 | 0.00 | 0.00 |

| 2022 | 0.00 | 0.00 | 0.00 | 0.00 |

| 2023 | 0.00 | 0.00 | 0.00 | 0.00 |

| 2024 | 0.00 | 0.00 | 0.00 | 0.00 |

| 2025 | -41.19 | -26.99 | -10.93 | -22.17 |

| ... | ... | ... | ... | ... |

| 2096 | -24.23 | -10.33 | -5.30 | -10.85 |

| 2097 | -24.09 | -10.25 | -5.25 | -10.78 |

| 2098 | -23.95 | -10.18 | -5.20 | -10.70 |

| 2099 | -23.81 | -10.11 | -5.15 | -10.63 |

| 2100 | -23.67 | -10.04 | -5.11 | -10.55 |

80 rows × 4 columns

(mpakreal['PAKCCEMISCO2?KN PAKNYGDPMKTPKN'].difpctlevel.

rename().plot(title="Emissions impact of a constant real $30 USD Carbon tax"));

The modified model, which preserves the real value of the carbon tax has a permanent and substantial negative effect on emissions. The impact is not at an unchanging level, reflecting in part adaptation within the economy. Of particular import is what is being done with the revenues from the Carbon tax. As the structure of GDP (shifts to less carbon intensive activities) carbon tax revenues fall even as the Carbon Tax rate rises.

Note, the percent deviation of emissions tends to decrease over time in this scenario principally because the level of activity (GDP) is higher with the Carbon Tax than without it. As a result, emissions are higher than they would have been had GDP remained unchanged. For the Pakistan model, the positive impact of the Carbon tax is mainly explained by co-benefits, notably reduced reliance on more distortionary taxes such as payroll taxes and because of reductions in informality and due to health and productivity benefits from lower pollution levels (see Burns et al.(2021) for more details how these effects operate in the Pakistan model).