Chapter 12 Welfare and access to durable assets in South Asia

Abstract:

Economic inequality may cover a wide variety of topics, most commonly, the distribution of income, expenditures, and wealth. In this analysis, we study the unequal distribution of durable assets between different groups in South Asia. We find that the cumulative percentage of access to assets by expenditures per capita rarely behaves as a flat line, which means access to assets is unequal. We find access to most assets has increased rapidly in South Asia, although unevenly for different levels of welfare. A few exceptions are assets that may be becoming obsolete, such as radios and land phones, for which access has decreased over time across the region for all levels of welfare. For most assets, including energy-using assets such as refrigerators and televisions, we see a positive relationship between access and expenditures per capita as expected. In contrast, assets may become less accessible in some cases as households become richer (for example, bicycles), suggesting they may have the characteristics of inferior goods.

Energy-using appliances, such as refrigerators, are taken for granted among households in developed countries. However, in South Asia these assets are still scarce and owning a refrigerator, for example, can have important consequences on the well-being of a family. Refrigerators may be common in urban areas of New Delhi, but they are almost non-existent in central Afghanistan. We study how access to assets increases with welfare with the help of harmonized data from SARMD. The possession of valuable assets that facilitate family labor in a meaningful way are quick indicators of household purchasing power and economic development in the region.

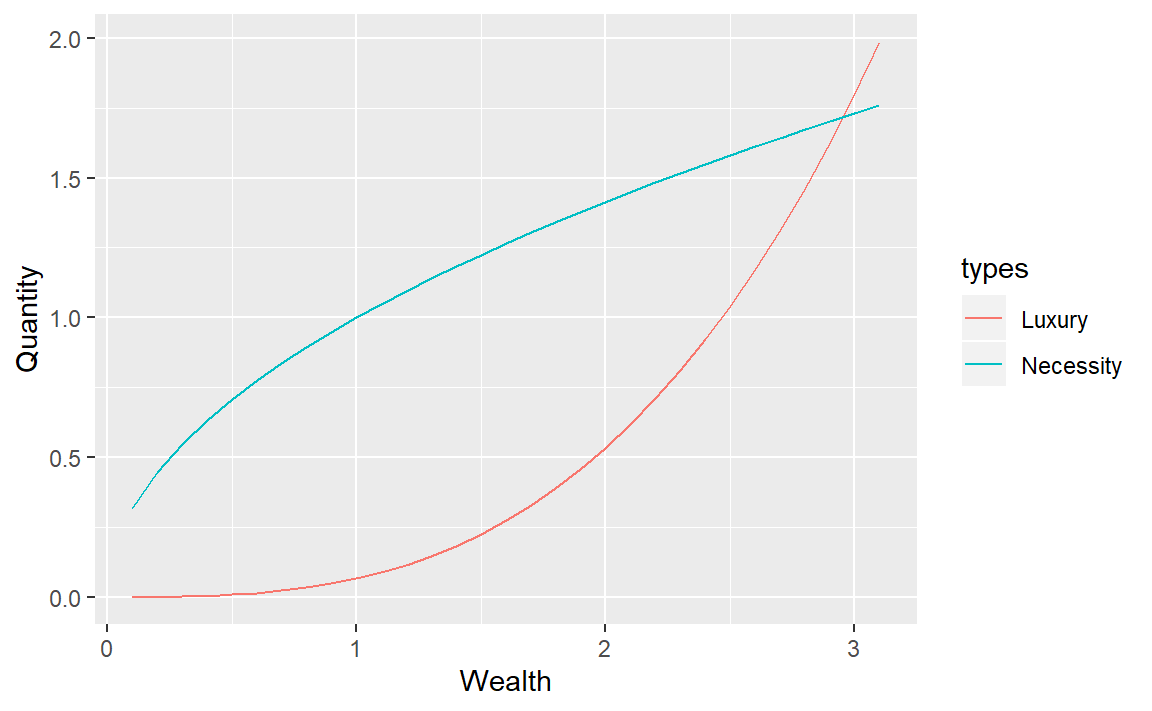

In microeconomics, an Engel curve describes how household expenditure on a good or service varies with households’ purchasing power. For normal goods, the Engel curve has a positive gradient. That is, as purchasing power increases, the quantity of assets demanded increases. For inferior goods, the Engel curve has a negative gradient. Both Engel curves in Figure 12.1 are upward sloping, but one bends toward the X-axis for necessities and the other towards the Y-axis for luxury goods.

Figure 12.1: Engel curves for normal goods

The harmonized asset variables in SARMD indicate, not the quantity demanded, but whether households have access to assets. For example:

| Variable | Description |

|---|---|

bicycle |

Household has access to a bicycle (1 = Yes 0 = No) |

cellphone |

Household has access to a cellphone (1 = Yes 0 = No) |

computer |

Household has access to a computer (1 = Yes 0 = No) |

landphone |

Household has access to a landphone (1 = Yes 0 = No) |

motorcar |

Household has access to a motorcar (1 = Yes 0 = No) |

motorcycle |

Household has access to a motorcycle (1 = Yes 0 = No) |

radio |

Household has access to a radio (1 = Yes 0 = No) |

refrigerator |

Household has access to a refrigerator (1 = Yes 0 = No) |

sewingmachine |

Household has access to a sewing machine (1 = Yes 0 = No) |

television |

Household has access to a television (1 = Yes 0 = No) |

washingmachine |

Household has access to a washing machine (1 = Yes 0 = No) |

Therefore, we do not know the quantity of assets demanded by each household and we are not able to present an Engel curve as described above. However, we may calculate the percentage of households with access to assets as shown in Figure 12.2. Access to assets like motorcars and computers is low on average in all of the surveys in SARMD, while access to cellphones and televisions may be low or high depending on the survey and year. Note that there is not a single asset for which access was high across all surveys.

Figure 12.2: Access to assets by survey

As more households currently living in poverty benefit from overall economic development, we would expect a considerable increase in households’ purchases of durable assets and energy use. An estimated 368 million people live without electricity in their homes in South Asia, and even among those who do have access, many do not own basic assets such as refrigerators, televisions, or washing machines. Wolfram, Shelef, and Gertler (2012) estimate the impact of increasing access to energy-using assets. According to their estimates, if one half of the households in India who do not own refrigerators were to buy one, annual nationwide electricity demand would rise by over 10 percent.

Figure 12.3 displays the wide gap that exists between countries in the percentage of households with access to these assets. For example, almost every household in the Maldives has access to a refrigerator, while access to a refrigerator is lower in the rest of the countries. The user may use the filters to display the same figure for different durable assets.

Figure 12.3: Assets to assets over time

We model the non-linear relationship between welfare and access to assets as in Gertler et al. (2016). These authors provide a theoretical framework to characterize the effect of income growth on asset purchases when consumers face credit constraints. A non-linear Engel curve means that as income goes up from initially very low levels, credit-constrained households do not immediately become more likely to purchase assets. Households faced with credit constraints only become likely to purchase assets once their income passes certain threshold levels.

Figure 12.4 presents the cumulative percentage of access to assets by expenditures per capita. A horizontal line would represent perfect equality in asset distribution, but that is rarely the case in the figures below. These figures show how unequal is the distribution of access to assets. In some cases, as in Gertler et al. (2016), we find an S-shaped relationship between households’ per capita expenditures and access to durable assets.

Figure 12.4: Cumulative access to assets by expenditures per capita

We provide some highlights from this analysis for each of the assets:

| Asset | Results |

|---|---|

| Bicycle | A negative slope may suggest bicycles are an inferior good, that is, it is more common for poor households to have access to them. |

| Cellphone | We see a quick increase in access to cellphones over time at all levels of welfare. |

| Computer | Access to computers only increases at levels of welfare above the poverty lines. |

| Electricity | Access to electricity is clearly lower for individuals below the 1.90 poverty line. |

| Ever attend school | This variable is technically not an asset, but we decided to include in this analysis. We can see positive slopes in every country, that is, poorer individuals are more likely to answer they have never attended any school. |

| Fan | Having access to a fan is clearly related to welfare. Richer individuals may afford this luxury and may also be the only ones with access to electricity to be able to use a fan. |

| Land phone | Having access to a land phone is clearly becoming obsolete, especially compared to the levels of access to cellphones. |

| Literacy | Literacy is increasing over time and still related to welfare. Illiteracy is clearly more common among the poorest individuals. |

| Motorcar | Having access to a motorcar seems to be more common for rich individuals in Afghanistan and Bhutan. |

| Motorcycle | Having access to a motorcycle is more common than having access to a motorcar. Having access to motorcycles has become more frequent over time, especially among richer individuals. |

| Own house | Compared to other assets, most households own the house they live in. Renting is common only among richer households in urban areas. |

| Piped water | Only Bhutan shows having almost universal access to piped water. |

| Radio | Another good that may be becoming obsolete are radios, with less households reporting having access to a radio over time at all levels of welfare. |

| Refrigerator | Having access to a refrigerator seems to be strongly related to welfare, with average access to it growing fast around the 3.2 poverty line. |

| Sewage toilet | No country shows evidence of high access to sewage toilets. |

| Sewing machine | Sewing machines seem to remain highly valuable in Afghanistan and Pakistan with more than 50% of individuals reporting having access to it. |

| Television | Televisions are a highly-desirable durable asset and are clearly more common among richer households. Having access to a television depends on having access to electricity. Both electricity and television follow similar trends. |

| Washing machine | Having access to a washing machine is clearly a luxury and only common among the wealthiest. |

You may access our full Stata do-file by accessing the following link.

References

Gertler, Paul J., Orie Shelef, Catherine D. Wolfram, and Alan Fuchs. 2016. “The Demand for Energy-Using Assets Among the World’s Rising Middle Classes.” The American Economic Review 106 (6): 1366–1401. http://www.jstor.org/stable/43861125.

Wolfram, Catherine, Orie Shelef, and Paul Gertler. 2012. “How Will Energy Demand Develop in the Developing World?” Journal of Economic Perspectives 26 (1): 119–38. https://doi.org/10.1257/jep.26.1.119.