Chapter 16 Development of Access to Cell Phone

According to GSMA real-time intelligence data, there are now over 8.97 Billion mobile connections worldwide, which surpasses the current world population of 7.71 Billion implied by UN digital analyst estimates. This data does show that in the world of wireless, 66.53% of the world’s population are now unique mobile subscribers (Turner 2018).

South Asia region has also experienced this development. in which cell phone users have significantly grown in all countries in the region during the last ten years. Except for Afghanistan, at least 80 percent of total population has access to cell phone in most recent years. In Nepal, the percentage of access to cell phone was less than 1 percent in 2003 but the ownership rate has jumped to 90 percent within 13 years. Even in other countries, 9 out of 10 households own cell phones.

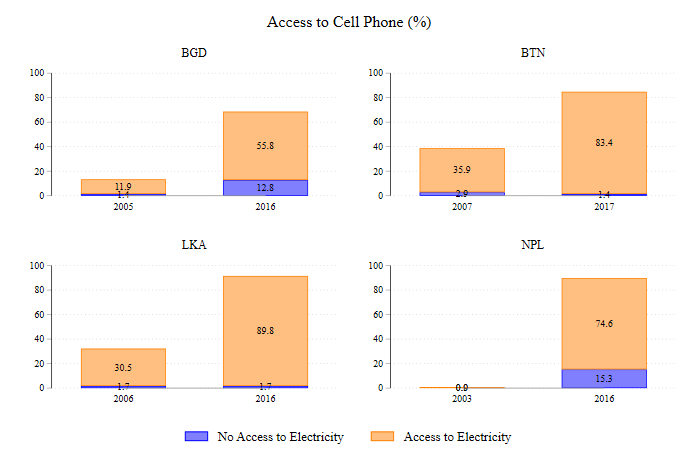

Surprisingly, and some of the households with cell phones do not have access electricity in their dwelling. How do they charge their devices? In Bangladesh and Nepal, 68.4 and 89.9 percent of households have access to cell phone but about 12.8 and 15.3 percent of those cell phone users do not have electricity in their dwelling.

Figure 16.1: Access to Cell Phone and Electricity

This implies higher entry barriers for accessing public infrastructure due to limited financial resources and administrative capacity in those countries compared to obtaining mobile devices.

The sharp growth of the access to cell phone presents greater opportunities for the region. Effective usage of technology such as cell phone may help compensate the shortage of infrastructure inherent in those countries. Also, low participation in development aid projects due to limited accessibility among vulnerable households can be improved since most households have cell phones.

Many development aid institutions already started utilizing cell phone applications in education, health and agriculture sectors by efficiently sharing knowledge with less expensive costs. One prominent example of taking advantage of this digital development is a mobile banking platform which has largely grown in India and Bangladesh (see Lee et al. 2017; Goyal, Pandey, and Batra 2012; Dixit and Ghosh 2013). Mobile banking service allows users to pay for everyday goods and services, repay loans, and send remittances to family without any physical obstacles (Dermish et al. 2011). Researchers have provided empirical evidence that the usage of mobile banking helps reducing poverty and enhancing living conditions (Demirgüç-Kunt and Singer 2017).

Technology has the potential to facilitate poverty reduction by overcoming obstacles of accessing important services among poor people. In maximizing such benefits, active investments on infrastructure will be crucial to make people use cell phones more freely, and continued software development that enables knowledge sharing will be a powerful instrument for reducing poverty (Demirgüç-Kunt and Singer 2017; Asongu and Odhiambo 2019).

You may access our full Stata do-file by accessing the following link. Our work consists of running the following command for each dataset and saving the results in order to export to Tableau.

References

Asongu, Simplice A., and Nicholas M. Odhiambo. 2019. “Mobile Banking Usage, Quality of Growth, Inequality and Poverty in Developing Countries.” Information Development 35 (2): 303–18. https://doi.org/10.1177/0266666917744006.

Demirgüç-Kunt, Asli, and Dorothe Singer. 2017. “Financial Inclusion and Inclusive Growth: A Review of Recent Empirical Evidence.” SSRN Scholarly Paper ID 2958542. Rochester, NY: Social Science Research Network. https://papers.ssrn.com/abstract=2958542.

Dermish, Ahmed, Christoph Kneiding, Paul Leishman, and Ignacio Mas. 2011. “Branchless and Mobile Banking Solutions for the Poor: A Survey of the Literature.” Innovations: Technology, Governance, Globalization 6 (4): 81–98. https://ideas.repec.org/a/tpr/inntgg/v6y2011i4p81-98.html.

Dixit, Radhika, and Munmun Ghosh. 2013. “Financial Inclusion for Inclusive Growth of India-A Study of Indian States.” International Journal of Business Management & Research 3 (1): 147–56.

Goyal, Vishal, U. S. Pandey, and Sanjay Batra. 2012. “Mobile Banking in India: Practices, Challenges and Security Issues.” International Journal of Advanced Trends in Computer Science and Engineering 1 (2).

Lee, Jean N., Jonathan Morduch, Saravana Ravindran, A. S. Shonchoyand, and H. Zamany. 2017. “Poverty and Migration in the Digital Age: Experimental Evidence on Mobile Banking in Bangladesh.” IGC Working Paper C-89233-BGD-1.

Turner, Ash. 2018. “1 Billion More Phones Than People in the World! BankMyCell.” BankMyCell. https://www.bankmycell.com/blog/how-many-phones-are-in-the-world.